Daily Insights Hub

Your go-to source for the latest trends and insights.

Instant Gratification: Why Businesses are Embracing Instant Payout Systems

Discover why instant payout systems are revolutionizing business transactions and how they can boost your profits today!

The Evolution of Finance: How Instant Payout Systems are Reshaping Business Transactions

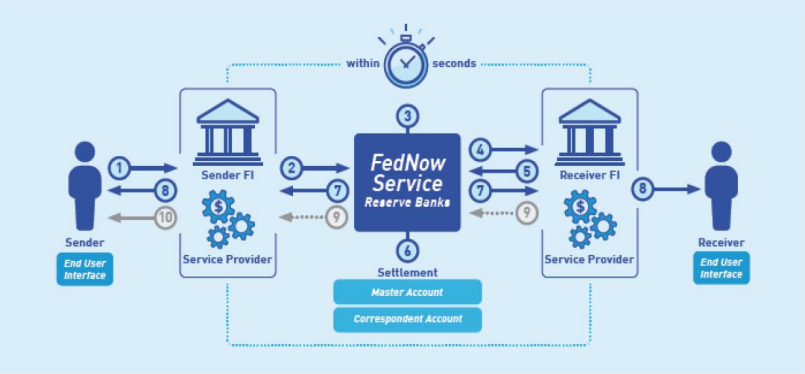

The financial landscape has undergone a remarkable transformation over the past few decades, transitioning from traditional banking systems to more agile and instant payout systems. These systems allow businesses to receive funds in real-time, eliminating the delays commonly associated with checks and traditional bank transfers. Instant payouts are not just a convenience; they are reshaping the dynamics of cash flow management. Companies can now respond faster to market opportunities, invest in inventory quickly, and improve their liquidity, all of which are critical to maintaining a competitive edge in today’s fast-paced economy.

Moreover, the adoption of instant payout systems has enhanced customer experience by providing seamless transaction processes. With features such as mobile payments and direct bank transfers, businesses can offer instant payouts to their clients, building trust and fostering loyalty. This shift not only streamlines operations but also opens up new avenues for revenue generation. As more businesses embrace these technologies, it is clear that the evolution of finance is steering us towards a future where business transactions are faster, more efficient, and highly customer-centric.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in competitive matches where tactics often determine the outcome. For those looking to enhance their gaming experience, using a clash promo code can provide valuable in-game benefits.

The Consumer Demand for Speed: Understanding the Rise of Instant Gratification

The consumer demand for speed has reached unprecedented levels in today's fast-paced world. With just a few taps on a smartphone, consumers can access a vast array of products and services instantly. This has given rise to the phenomenon of instant gratification, where immediacy is not just a preference but an expectation. Research indicates that as technology continues to evolve, particularly with the advent of high-speed internet and mobile connectivity, more consumers are prioritizing quick and effortless solutions over traditional methods. Brands must now adapt to this shift in consumer behavior by streamlining their services to meet the desire for speed.

Moreover, the impact of social media cannot be understated in the context of instant gratification. Platforms like Instagram and TikTok have created a culture where users expect immediate feedback and fulfillment. This trend influences purchasing decisions, as consumers are often driven by the fear of missing out (FOMO) and the desire for real-time engagement. To capitalize on this trend, businesses must consider strategies that cater to the consumer demand for speed, such as enhancing website loading times and implementing one-click purchasing options, which significantly enhance the overall customer experience.

Are Instant Payout Systems the Future of Payment Processing for Businesses?

The advent of instant payout systems marks a transformative shift in the landscape of payment processing for businesses. Traditionally, companies faced delays in receiving funds due to various banking and processing protocols, often resulting in cash flow challenges. However, with the rise of technological innovations, instant payout systems provide businesses with the ability to access their earnings in real time, thus enhancing liquidity and operational efficiency. This capability not only improves financial management but also allows businesses to invest in growth opportunities without the typical waiting period associated with conventional payment methods.

Moreover, the allure of instant payouts extends beyond mere convenience; it fosters stronger relationships between businesses and their service providers or employees. For instance, gig economy workers and freelancers benefit immensely from immediate access to their earnings, thereby affirming their trust and loyalty to the platforms they engage with. As consumer preferences continue to evolve towards speed and transparency, businesses that adopt instant payout systems could gain a competitive edge, positioning themselves as modern and responsive entities in a fast-paced market environment. It’s clear that the future of payment processing will likely hinge on the adoption of these innovative solutions.