Daily Insights Hub

Your go-to source for the latest trends and insights.

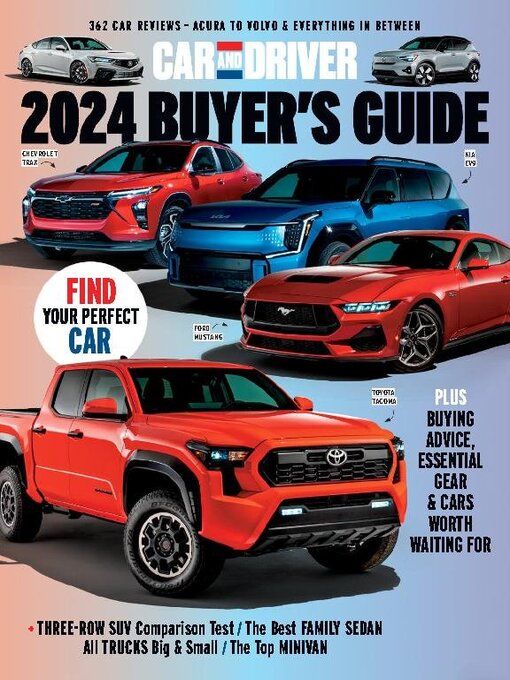

Don't Get Burned: Your Roadmap to Smart Car Buying

Discover the ultimate guide to smart car buying and avoid costly mistakes—your roadmap to a hassle-free purchase awaits!

Top 5 Mistakes to Avoid When Buying a Car

Buying a car can be an overwhelming experience, especially for first-time buyers. To help you navigate this process, here are the top 5 mistakes to avoid when buying a car. First and foremost, skipping research is a common pitfall. It's essential to thoroughly investigate various models, their features, and pricing trends in the market. Failing to do so can lead to paying more or choosing a vehicle that doesn't meet your needs.

Another significant mistake is neglecting the total cost of ownership. It's not enough to focus solely on the purchase price; you should also consider insurance costs, maintenance, fuel efficiency, and depreciation. Additionally, not obtaining pre-approval for financing can leave you vulnerable to unfavorable loan terms. Lastly, overlooking the importance of a test drive can cause you to miss out on potential issues that may not be apparent when simply inspecting the car. By avoiding these errors, you can make a more informed and confident decision when buying your next vehicle.

How to Evaluate a Used Car: A Step-by-Step Guide

When considering the purchase of a used car, it's essential to methodically evaluate it to ensure you're making a sound investment. Start by researching the vehicle’s history using resources like Carfax or AutoCheck, which can reveal crucial information such as previous accidents, title status, and service records. This initial investigation can provide insights into whether the car has been well-maintained or if it has potential red flags. Once you're satisfied with the history, proceed to inspect the car physically.

In the next step, conduct a thorough physical inspection of the vehicle. Look for any signs of wear and tear, such as rust, scratches, or dents. Inspect the tires for even tread wear and check under the hood for any leaks or corrosion. It’s advisable to take the car for a test drive, paying attention to how it handles, any unusual noises, or warning lights on the dashboard. Finally, consider having a trusted mechanic conduct a pre-purchase inspection to uncover any underlying issues you might have missed. Following these steps will ensure you evaluate a used car effectively and minimize the risks involved in your purchase.

Is Leasing or Buying Right for You? Key Considerations

When deciding whether leasing or buying is right for you, it's essential to consider your financial situation and long-term goals. Leasing often requires a lower upfront payment and may include benefits such as warranty coverage, allowing for more cash flow flexibility. On the other hand, purchasing can lead to long-term savings, as you have ownership of the asset and can avoid ongoing monthly payments after the financing period. Here are key points to evaluate:

- Initial Costs

- Monthly Payments

- Maintenance Responsibilities

- Asset Ownership

Another critical factor in this decision is how you plan to use the asset. If you expect to use it frequently and need the latest technology, leasing may be advantageous due to its shorter commitment period, enabling you to upgrade frequently. Conversely, if you plan to use the asset for a prolonged time or intend to personalize it, buying may be the more suitable option. Additionally, consider your mileage or usage needs; many leases come with limitations that can incur extra fees if exceeded. Thus, understanding your lifestyle and usage patterns is pivotal in making the right choice.